Why agility, creativity, and connection will matter more than ever.

By Todd Reinhart, Partner & Co-Founder at Deadlizard

Introduction

The media and entertainment industry is at a crossroads, grappling with fundamental shifts in how content is consumed and advertising dollars are spent. Linear TV, once the cornerstone of ad revenue, is fading as younger audiences embrace digital platforms. At the same time, brands are scrambling to adapt to a fractured and fast-evolving market.

This isn’t just about changing channels; it’s a reckoning. Audiences under 40, particularly those under 30, have fully embraced streaming and on-demand content, leaving advertisers struggling to reach the next generation of consumers. For media companies and agencies, the old playbook no longer works. Survival means adapting quickly, understanding the new dynamics of audience behavior, and crafting hyper-targeted campaigns.

Let’s unpack the challenges and the opportunities.

The Decline of Linear Programming and the Rise of Fragmentation

Audiences are moving away from appointment programming at breakneck speed. Recent studies show that viewers under 30 consume nearly 90% of their media digitally, leaving linear channels to cater primarily to audiences aged 65 and older. While this older demographic remains valuable, advertisers are far more interested in capturing the buying power of younger consumers. Increase your sales with digital strategy for your online store.

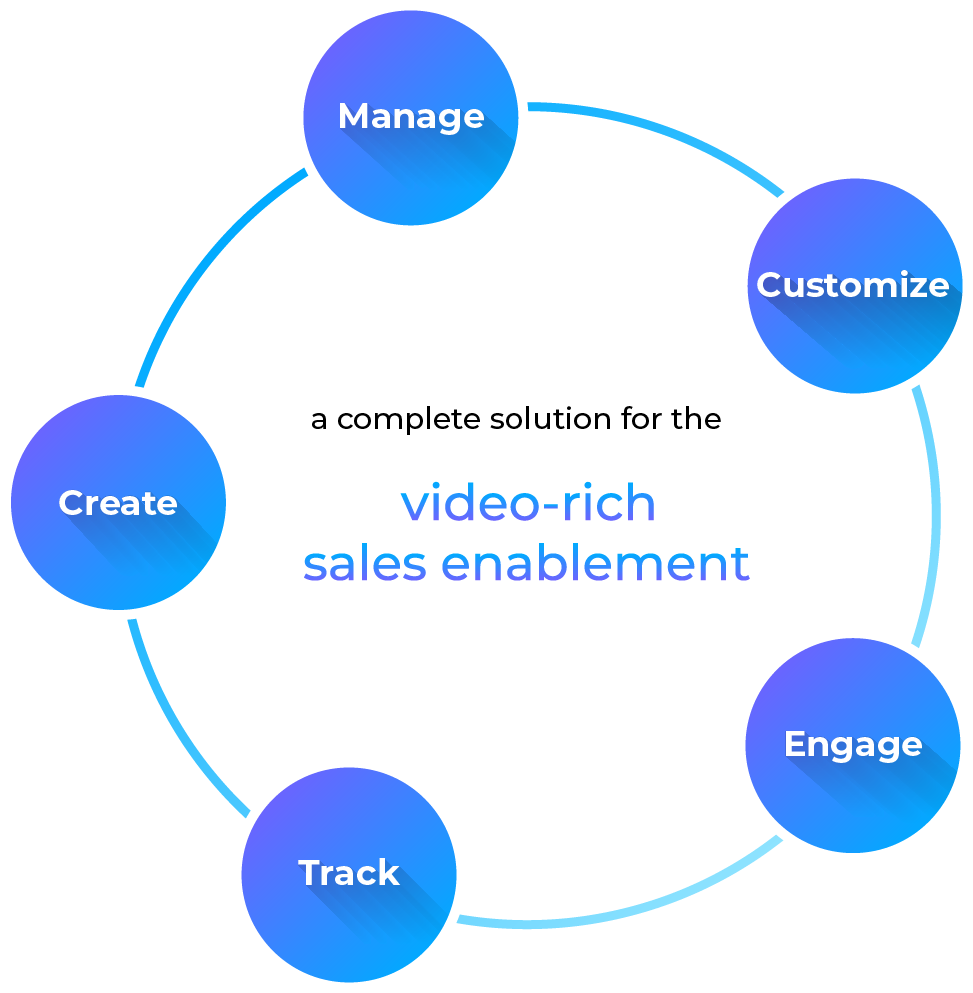

We’ve worked with clients grappling with this shift, watching as they transition from relying on legacy models to embracing new, multi-platform strategies. These companies often face a steep learning curve, but by leveraging digital-first approaches—tailoring content for social media, streaming services, magic pitch platform and even niche platforms—they’ve managed to stay relevant. The takeaway? You need to go where the audience already is.

Data is the New Currency

Today, advertising isn’t just about impressions; it’s about intelligence. Platforms like Amazon and Samsung are leveraging consumer data to an unprecedented degree. Samsung’s smart TVs, for example, track everything from who’s in the room to how long you’re watching. This granular insight allows advertisers to target with pinpoint accuracy.

For media companies, this presents both an opportunity and a challenge. While large platforms have the resources to analyze and act on this data, smaller companies need to find creative ways to compete. By prioritizing partnerships with tech-forward platforms and investing in analytics, even smaller players can deliver the kind of targeted campaigns that advertisers demand.

The Rise of Bundling and Dynamic Value Propositions

Media conglomerates are using bundling strategies to maximize ad revenue, often forcing buyers to split budgets across linear and digital properties. Disney recently exemplified this approach, tying premium digital ad buys to discounted linear placements. For smaller networks, this can create significant challenges.

But it’s not all doom and gloom. Smaller companies often thrive by emphasizing niche audiences and hyper-targeted content. We’ve seen clients lean into their unique strengths, offering tailored pitches that showcase specific value to advertisers. This dynamic approach allows them to compete against larger players by delivering measurable ROI for narrowly focused campaigns.

Audiences Demand High-Quality Content Across Every Channel

In an era where streaming quality and user experience are paramount, low production values are no longer excusable. Media buyers expect polished presentations that reflect the innovation and creativity they’re purchasing. Anything less risks alienating the audience and undermining the brand.

We’ve seen this play out in scenarios where weak infrastructure led to buffering or delays during remote presentations. The solution? Investing in robust delivery systems and ensuring that creative assets maintain their quality across devices and platforms. For media companies, seamless execution isn’t a luxury; it’s a necessity.

Conclusion: Embracing Evolution

The upheaval in the media and entertainment industry is a lot like the uncertainty parents feel as they guide their children into an unknown future. What careers will be viable in 20 years? What tools will still be relevant? Similarly, media companies are navigating uncharted waters, pivoting from linear models to fragmented, data-driven strategies.

But there’s good news. Advertising is more important than ever—it’s just spread across more touchpoints. Media companies that adapt to these shifts, leaning into data, creativity, and agility, will find themselves well-positioned to thrive in this evolving landscape.

In 2025, the winners won’t be the ones clinging to the past—they’ll be the ones rewriting the playbook.

About the Author

Todd Reinhart is a Partner, Founder, and Design Director at Dead Lizard, specializing in developing communication strategies and visual stories that help big brands such as the Scripps Network, NBC, and the Hallmark Channel connect more effectively with their audiences. Todd believes that all great design stems from understanding and empathy—without it, communication isn’t possible. As he often says, “Design is simply communicating without speech.

Sources

- “Digital Media Consumption Trends: Generational Shifts in 2025.” eMarketer. Accessed December 2024.

- “The Rise of Smart TV Data: Advertising in the Streaming Era.” AdWeek. Accessed December 2024.

- “Disney and the Future of Bundling in Media.” Variety. Published November 2024.

- “Linear TV vs. Digital Platforms: Advertising’s Changing Frontier.” MediaPost. Published October 2024.

- “Consumer Behavior: Streaming Services vs. Cable in 2025.” Nielsen Research. Accessed December 2024.